YOUR NEXT LEVEL INCOME.

You get perks and benefits that get you more from your money!

YOUR INCOME. OPTIMISED.

We give IT contractors the best of both worlds… Contractor wages with employee-like benefits.

At Perk Payroll, we work with your labour hire company and optimise your income by providing benefits to you, claiming approved expenses from your pay and reimbursing you the full amount.

Because we think differently about your expenses and leverage these against your income, you get an immediate reduction in your income tax and medicare levy and full reimbursement of the GST, every time you submit expenses with your time sheet.

We put more money in your pocket every week, adding up to thousands of dollars every year!

When working with Perk Payroll you are able to assign expenses to employee-like categories, which enables you to claim for more things than an individual can on their tax return.

So, when you buy something that falls into one of our categories, you get an immediate deduction in your next pay and do not need to wait until the end of the financial year to make that claim. To top it all off, you don’t need to depreciate the expenses over a number of years.

This lowers your taxable income even further, so you end up with more money in your pocket.

MULTIPLE EXPENSE CATEGORIES TO LOWER YOUR TAXABLE INCOME.

THE PERK PLAYBOOK.

Our playbook is the how-to guide for getting more from your money.

At the heart of Perk Payroll, is our Perk Playbook.

We use our playbook when working with IT contractors just like you, to optimise your pay and to enable you to get more from your money.

Our playbook contains our tips, perks and benefits that will put thousands of dollars into your pocket every year and it is yours to download for free!

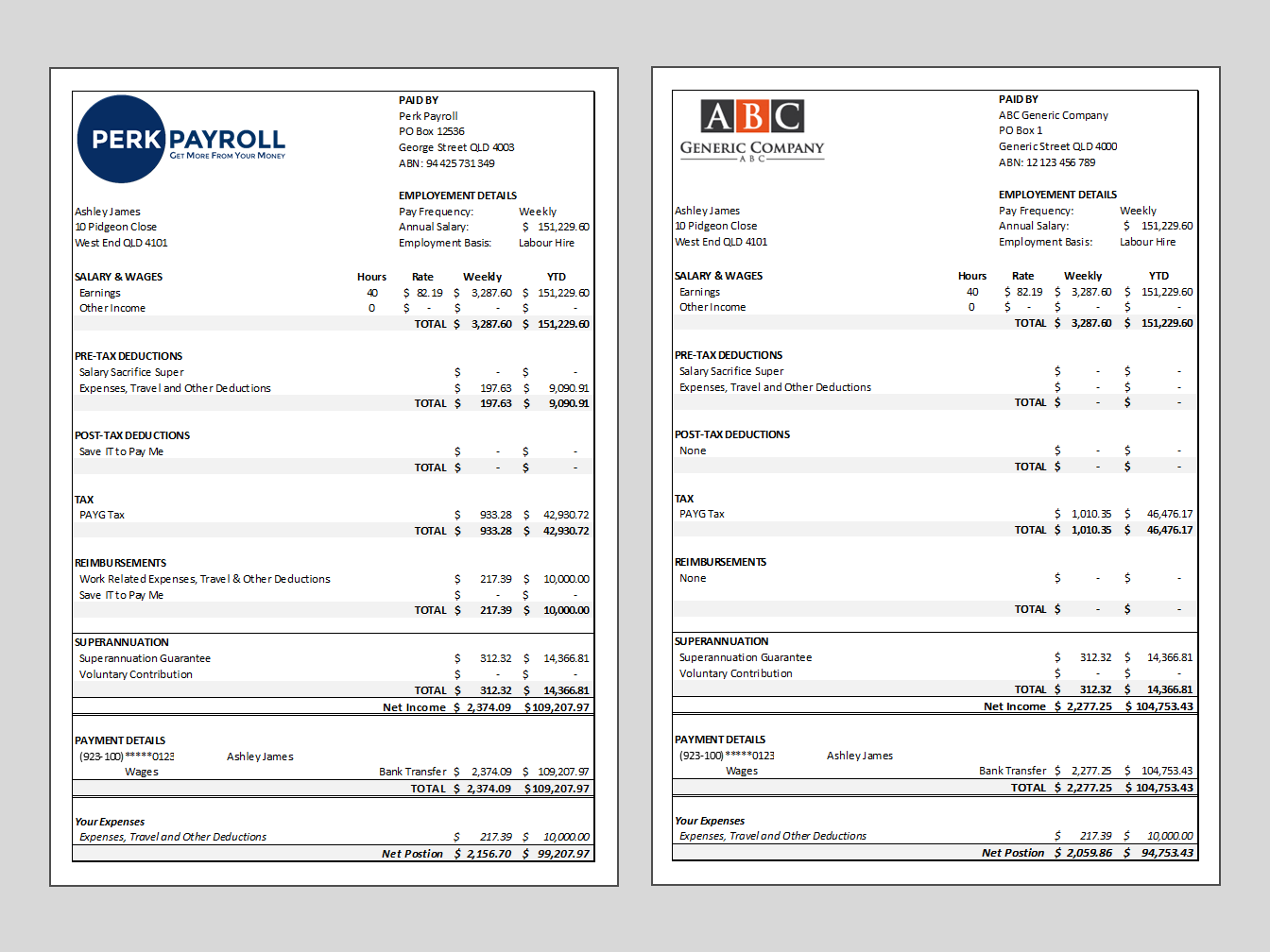

DARE TO COMPARE.

With Perk Payroll, you will pay less tax and have more money in your pocket!

Still wondering how effective Perk Payroll really is?

Let’s take a client who earns $90 per hour (including Superannuation) and they spend $10,000 on work related items, work related expenses, travel, superannuation contributions and allowances over the year.

Perk Payroll applies the $10,000 deduction against their pre-tax income, which significantly lowers their taxes and adds it back to their pay as non-taxable earnings.

This provides immediate savings of $4,454 over the year or a 44.5% discount on their expenses!

How’s that for getting more from your money!

An extra $4,454 paid into their bank account with their pay.

Download our comparison pay slips and case study for free!